By: Patrick Ungashick

The following case study is based on a true story. For owners of closely held businesses, this case study highlights the importance of engaging an experienced and professional exit planning team. Even when an exit plan looks like it will work at a high level for all parties involved, there are often hidden problems and issues that can cost the exiting owner millions of dollars. Therefore we recommend that all business owners seek help from professional exit planners, like our NAVIX Consultants.

Download Can One Exit Plan Save a Million Dollars, Twice? Case Study (PDF)

Key Lessons:

One of the four possible exit strategies is to sell the company to an inside buyer, such as a business partner or a key employee. At NAVIX, we call this an “Innie” Exit Strategy. A key risk for this type of transaction is excess taxation.

- Transaction Taxes – Funds bonused to the employees for the buyout will be taxed as ordinary income, and then taxed again at capital gains rates when they are paid to the outgoing owner.

- Estate Taxes – If the owner has significant other assets, the transaction proceeds may get taxed again at the estate tax rate, which is currently set at 40% for most taxpayers.

- Control – If payments are going to be made over time, the exiting owner will need to retain some form of control over the company.

- Professional Help – Most business owners do not have the expertise and experience to know all the potential risks and opportunities associated with exiting their business. They should seek help from a professional exit planning team

Can One Exit Plan Save a Million Dollars, Twice?

Scott Maxwell owned Buildup Inc., a contract manufacturing company that was profitable and growing under the leadership of Scott and his Chief Engineer, Johnny. With his sixtieth birthday well behind him, Scott began to think about exiting the company to spend more time at his cabin in the mountains. While the company would likely have attracted a lot of outside buyers, Scott’s first choice was to sell the company to Johnny, who had helped build it so successfully.

Scott came to NAVIX with a detailed plan for selling the company to Johnny. The plan involved a series of loans and installment payments to make the numbers work for both parties. Scott’s initial plan did a lot to change the timing of cash transfers from Johnny, but it did nothing to address taxes. Johnny was not independently wealthy, so the money for the acquisition would have to come from the income that the company would generate with Johnny at the helm. Based on the forward projections for the company, Scott and Johnny agreed that the highest amount of cash that could safely be diverted from the company to fund the purchase would be $700,000 per year. They also agreed that 10 years at $700,000 would be a fair amount to divert for the total purchase price.

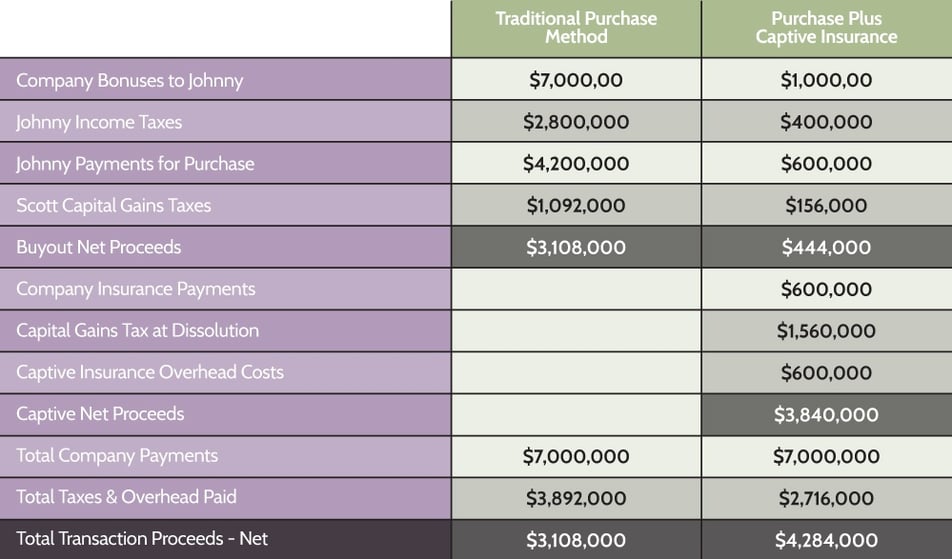

A high level view of the transaction, ignoring the time shifting from loans, yielded the following tax picture: The company would pay Johnny $7 million over time. Johnny would pay 40% income taxes on that money and then have $4.2 million to pay Scott for the company. Scott would then pay 26% federal and state capital gains taxes on the proceeds, yielding a net of $3.1 million. Total taxes paid by both parties would be $3.9 million or 56% of the original $7 million.

After doing some analysis on Scott’s exit plan and his company’s insurance needs, NAVIX suggested that Scott consider starting a captive insurance company. Johnny would pay Scott $1 million for the company, which was in line with its book value, and then pay $6 million worth of premiums into the captive insurance company over 10 years. The captive premiums would be deductible to the company, and they would not be taxed at the insurance company level either. After 10 years of premiums, the insurance company could be dissolved and, based on current tax law, the principal would be taxed at the capital gains rate. In this scenario, total taxes paid would be 56% or $556,000 on the $1 million purchase price, plus 26% on the potential $6 million insurance company balance for another $1.6 million. So, total taxation in this scenario would be $2.1 million. Captive insurance companies have high overhead costs, which would total approximately $600,000 over 10 years, so total taxation and administration costs would be $2.7 million.

Therefore, over the full term of the plan, Scott is on pace to save nearly 1.8 million in transaction related taxes. Even allowing for the captive insurance overhead, the net proceeds from the transaction are projected to be $1.2 million higher due to the exit plan enhancements.

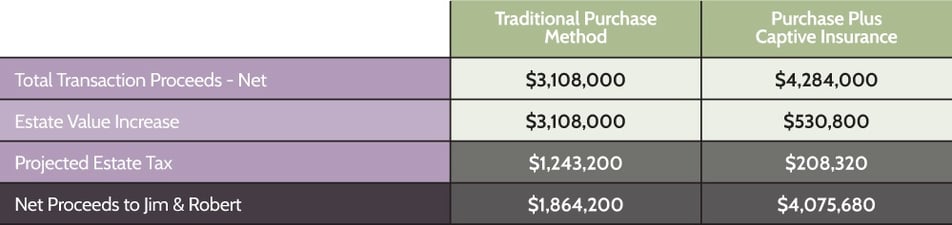

So, the exit plan saved well over a million dollars in taxes once. How did the same plan do it a second time? In addition to the company, Scott has other assets that pushed his total net worth over the $10.8 million tax-free gifting threshold for a married couple. Therefore every incremental dollar received from the sale of the company would be subject to the estate tax, currently set at 40%, when he passed it on to his two sons, Jim and Robert.

However, the improved exit plan was able to help with this estate tax as well. If Scott had followed his original plan, the $3.1 million of net transaction proceeds would have increased his overall estate and would have been subject to more than $1.2 million of estate taxes. In the updated exit plan, Scott gave 49% of the stock in the captive insurance company to Jim and another 49% to Robert. By doing this at the outset, Scott was able to award the stock when it had no value. With this plan, 98% of the insurance company proceeds will flow directly to Jim and Robert with no estate taxes.

Scott’s estate would only increase by the value of his 2% of the insurance company plus the $444,000 he netted from the $1 million purchase price, yielding projected estate taxes of just $208,000.

In addition to all the other benefits of having a sound exit plan, Scott’s family was able to save $1 million or more in taxes twice, first by lowering the transaction taxes by nearly $1.8 million, and then by lowering the projected estate taxes by another $1 million.