By: Patrick Ungashick

One of the four possible exit strategies for business owners is to pass the business down to family members. We call this the “Passers” strategy.

Most owners of closely held businesses invest decades of sweat, risk, and sacrifice into their businesses. Business success may already have brought you a personal sense of achievement and significant financial rewards. However, what happens when you exit your business, and you reach your end zone, likely defines your career too.

Your exit should be the crowning achievement of a career, the fulfillment of financial and family dreams, the next chapter in a business legacy. It is a cause for celebrating—for dancing in the end zone.

If your exit strategy is to pass your business to family members, we call that the “Passer’s Strategy.”

A Passer’s defining motivation is to smoothly transfer the business to a successor family member or members. As long as personal financial security and freedom are achieved, most Passers are not concerned about getting “maximum value” for the business. You act from the heart rather than the wallet.

Contrary to selling the business to an outside or an inside buyer, Passers encounter different sets of challenges and inherent strengths that they must face. They must find answers to questions such as, “How do I guarantee my kids don’t blow it?” and “how can I be fair to children not actively working in the family business?” Woven into these questions and issues are family dynamics, relationships, and realities.

Here is the Passer’s Playbook that may assist you with getting closer to the end zone.

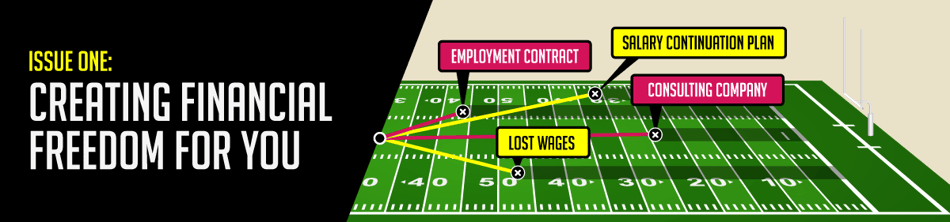

- Playbook: Employment Contract

The business may pay you a reasonable amount for your role and responsibilities. - Playbook: Consulting Company

Instead of working as an employee after your exit, consider working as a consultant. The business may pay a reasonable amount for your services—often higher than what might be reasonable if you were an employee. - Playbook: Salary Continuation Plan

A salary continuation plan is a formal compensation agreement to continue the reasonable salary of a key employee after termination of service.

Salary continuation plans are often used to honor many years of exemplary service and motivate top employees to stay until normal retirement age. - Playbook: Lost Wages

Lost wages are payments to an employee to make up for a period of time when that employee received below-market compensation. Many owners have experienced periods when they paid themselves low or even no wages. Comparing these periods against typical compensation for similar positions based on industry, business size, and location generates a pool of “lost wages” that may be paid to you now or at exit.

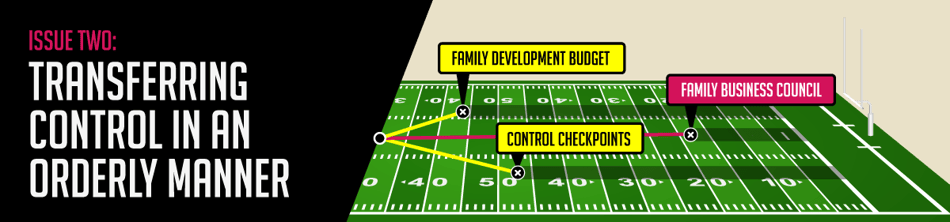

- Playbook: Family Development Budget

Your business probably has a budget for increasing sales, developing new products and services, improving operations, and training employees. Is your family’s development any less important to your business than these other items? Setting a Family Development Budget notifies everybody that you take this issue seriously and puts resources into your efforts. The budget should be large enough to be effective without being unaffordable. - Playbook: Control Checkpoints

Devise a series of Control Checkpoints that plot the path. Assign one set of responsibilities to your child, evaluate progress and turn over more only when the Checkpoints are fully met. - Playbook: Family Business Council

Consider forming a Family Business Council (FBC) to provide a structured forum for the family to meet and discuss business matters on a scheduled basis. The Council can help build trust and rapport for all generations, avoid potential miscommunications, and assist in the younger generation’s development as business leaders.

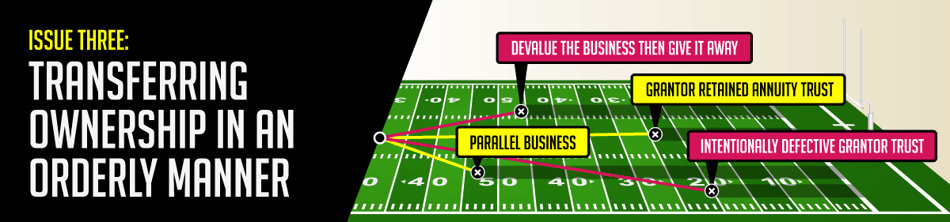

- Playbook: Devalue the Business then Give it Away

In most situations, Passers want to establish the lowest reasonable valuation for the business. Devaluing the business does not mean undermining the business’s profitable activities. The goal is to reduce the value that may be claimed on a tax return; a lower value creates the potential for lower transfer taxes. - Playbook: Parallel Business

This involves setting up a new business entity, owned mostly or entirely by your child, alongside your existing business. Once the parallel company is established, migrate over time business activities from your existing business to the new business. - Playbook: Grantor Retained Annuity Trust (GRAT)

The major advantage of a GRAT is it transfers the business to your child at a reduced value, thereby reducing potential gift or estate taxes. The value of the asset transferred—which is the business—is reduced by the value of the income stream owed back to you. - Playbook: Intentionally Defective Grantor Trust (IDGT)

Unlike the GRAT, with an IDGT you sell rather than gift the business interest to the trust. Because the transaction is a sale, gift limitations such as the Asset Transfer Allowance do not apply. (There is no limit on how much you may sell to another party.) This allows the IDGT to help transfer larger business interests than possible with a GRAT.

- Playbook: Family Balancer Trust

This irrevocable trust establishes a dedicated pool of assets for children who do not receive business interests. You may contribute any asset to the trust, but in many cases, the most effective tool is life insurance on you (or you and your spouse). - Playbook: Asset Lease Backs to Non-Working Children

This tactic may help balance assets within your family. Consider giving (now or at your death) your children not active in the business leased-back assets. This creates a potential income stream from the business for those heirs, but without sharing actual ownership. - Playbook: Non-Voting Stock for Inactive Children

If you must consider dividing ownership among active and inactive children, consider transferring only non-voting stock to inactive children. Children not working in the business will not have input on how the business is run but may enjoy some of the economic rewards such as periodic distributions or cash if the business is sold.

- Playbook: Irrevocable Life Insurance Trust

Put your life insurance in an irrevocable trust. When properly structured, assets held by an irrevocable trust may be outside your taxable estate. Existing policies may be gifted or sold to the trust in many cases if it is desirable to keep those policies.

Click here to download the Full 'Passers Game Plan' infographic