By: Patrick Ungashick

Athletes, celebrity entertainers, politicians, models—everybody seems to want to “go out on top” at the end of their careers. At first glance, it should be the same for business owners; they, too, should strive to go out on top when they exit from their business. After all, in order to sell the business for maximum value, create a sustained business legacy, and exit under their own terms, owners should exit at the business’s peak—right? Perhaps not.

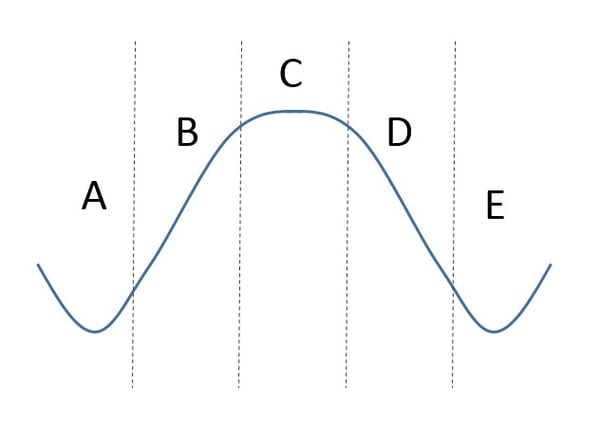

Few companies grow in a perfectly straight upward line; most experience varying rates of growth over time. Consider the following simple illustration of a business’s growth cycle, divided into five phases, lettered A through E.

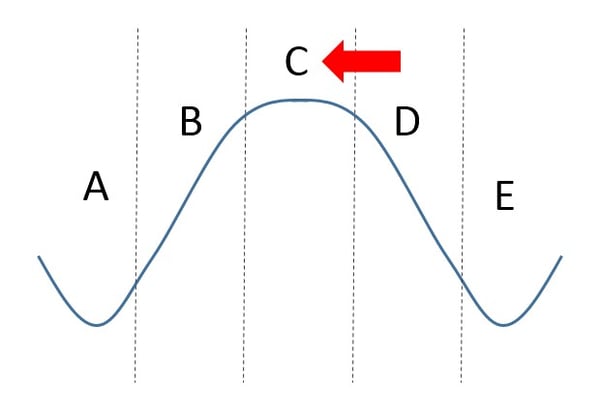

Ask a room full of business owners which is the ideal phase from which to exit their company, and the most common answer is Phase C as shown below.

On the surface this makes sense. If your goal is to sell the business for its maximum value, it seems logical to sell when revenues and profits are at their highest. If you want your company to continue so that employees and customers are not left stranded, then you might also think that the business needs to be at peak performance to survive the transition. However, it often does not work that way.

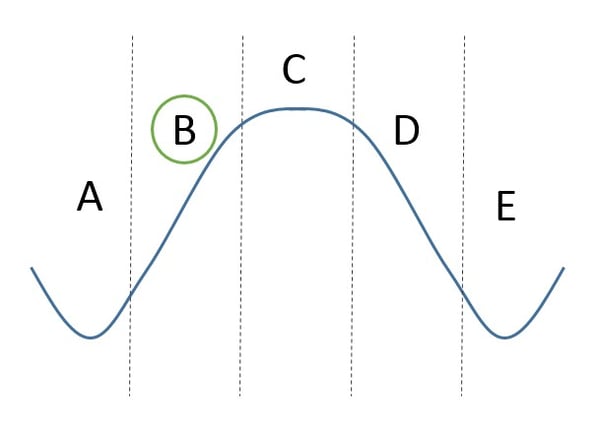

To achieve a happy and successful exit, do not go out on top. Rather than exit at Phase C, owners must consider exiting at Phase B in order to achieve their best results.

Here is why. Let’s examine the goal of selling a business for the maximum value. While there are many factors that contribute to a business’s sale price, one of the most important is the company’s prospects for future growth. Buyers do not purchase a business for its past performance—they only use past performance as a reference point for evaluating the future growth. A business that has peaked is potentially less valuable to a buyer if the company’s revenues and profits may be expected to slow or decline in the immediate future. Buyers need to believe that the business’s next three to five years are likely to be a time of continued profitable growth. That is Phase B, not Phase C.

There is a second reason to consider selling a business to maximize value during Phase B rather than Phase C. About two-thirds of business sales include an earn-out for the seller. Earn-outs are a provision in the deal where the seller may receive additional future compensation based on the business achieving certain future results, such as revenue or profitability goals. Selling the business at its peak in Phase C could lead to receiving less or even nothing from the earn-out.

Next, let’s examine the goal of creating a sustained business legacy. Owners who exit at the peak are turning over their company to successors right when that business is potentially about to go through a difficult time. As the business leaves Phase C, it will likely experience some or all of the following: slowed growth, reduced profits, tightening cash, shrinking margins, increased competition, or declining backlog. Turning over a business in that environment is not a recipe for a smooth transition and does not bode well for creating a sustained business legacy. Owners who want their companies to not only survive their departure but also thrive after their exit may need to act in Phase B, not Phase C.

Last, let’s examine the goal of exiting on one’s own terms. For many owners, this means during and after exit they need to have peace of mind that they did things the right way. Achieving peace of mind comes from honoring employees, respecting customers, acting consistently by a set of values, and upholding the company’s reputation. Owners who exit in Phase C risk jeopardizing all of this, again because of the potential difficulties the business may face ahead as it leaves Phase C. The new owners and leaders may need to take corrective actions such as cutting jobs or scaling back services, undermining the outgoing owner’s sense of leaving the company in good condition.

For all of these reasons, it may be advantageous not to exit on top, but rather before the company reaches its next performance peak. This is easier said than done. First, you must assess where the business is within these various phases. While it is impossible to predict the future, it is possible to make forecasts based on careful monitoring of industry and economic trends, combined with proven strategic planning processes. You are not guaranteed to be right, but a sound forecast increases the likelihood of success.

The second major challenge when attempting to exit prior to the company’s peak is emotional—it is difficult to leave a business in Phase B. Phase B typically produces some to all of the following: rapid sales growth, increased profits, strong backlog, improved margins, surplus cash, eager customers, and high employee morale. Few owners want to exit from a company while having that much fun. Yet to exit successfully, that is often what is required.

Consider watching our on-demand informational webinar on how to know when it’s time to exit.