One of the most common, and important, questions business owners ask is “When should I start my exit planning?”

Ideally, you need to begin serious planning no less than five years before your desired exit. Your final 60 months will make or break your exit success.

1. Why Does Every Business Owner Need an Exit Plan?

Can’t you just focus on building and growing an excellent company, and the rest will take care of itself?

Ultimately, there are two reasons why just building a strong business is not enough to be assured of a successful exit. These two reasons best explain why every business owner needs to create and follow an exit plan—years before you intend to exit.

Let’s call the first reason the “Unknown Destination Effect.” Imagine you’re out for drive, but don’t have a clear destination in mind. Without knowing where you want to end up, it’s impossible to know if the next left or right turn will eventually lead you to anywhere good.

Sometimes taking a drive on a beautiful day without a known destination can be fun. But when it comes to your business, generally you want to know where you are going. Leading your company without a clear set of exit goals is the same as driving around with an Unknown Destination. You end up making decisions without knowing if they will lead you anywhere good by the time you arrive at your future exit.

Here are several examples of important business decisions that, without a clear exit plan, you won’t know which decisions will help or undermine your exit success:

- Which will have a bigger impact on your business’s value at exit – top-line revenue growth or bottom line profitability growth?

- How do you decide to add staff, which can strengthen the team in the future but often decreases profits in the short term?

- Should you trim any under-utilized labor, knowing it may cause current disruptions but can increase profits and potential sale value?

- How do you evaluate a strategic initiative that may contribute to long-term growth but will consume significant current resources and reduce profits?

- Which will produce a greater impact on business value: vertical or horizontal growth?

These are important business decisions, that, without an exit plan to follow, you cannot know whether or not your answers will help or hurt whenever you finally arrive.

The second reason that every business owner needs an exit plan is the law that “Time Increases Results.” This “law” refers to nearly universal truth that the more time allocated to accomplish a goal or project, the greater the probable results.

When it comes to achieving exit success, it’s often a surprise to business owners that many of the most important tools and tactics will take years to implement, and/or produce results that positively compound with years of time. In our experience, five years is the critical mark—if your desired exit is five years or less from now, you already may be running short of time to implement certain tools and tactics, and/or you may see greatly diminished results from your efforts.

Here are a few examples of issues that many owners have to address to maximize results at exit, but which can take years to fully accomplish:

- Eliminate any dependency on the business owner for sales, operations, or key relationship management

- Identify, hire, onboard, and align a leadership team that produces a track record of sustained long-term growth

- Outgrow any customer/client concentration

- Create brand value protected in a defensible IP portfolio

- Time market conditions to your advantage

- Evaluate and implement significant exit tax-saving strategies

- Address any misalignment or disagreements between co-owners

- Design and implement ownership and leadership transfer plans (if exiting to key employees or family)

Having a clear, written exit plan helps business owners evaluate and prioritize needs such as these, early enough so that time helps produce and compound positive results.

Put these two reasons together: The “Unknown Destination Effect" and “Time Increases Results” and it becomes clear that exit success requires more than just building a good company. The sooner you get started with your exit planning, the greater your likely success.

5 years = 60 months = 1,825 days

When we ask business owners when they want to exit, the most common answer is something like “Oh, about 5 to 10 years from now.” Let’s look at five years. Quick math shows five years and 1,825 days are the same length of time. But if you have a major future goal that is five years away, does it matter if you say the goal is 1,825 days away?

Apparently it does. Psychologists have shown that people told their goal was a certain number of days away were far more likely to take action now to prepare. For example, in one test participants told they had save money for a new child’s college education were four times more likely to start saving now when presented with information that college started in 6,570 days, rather than in 18 years.

One of the biggest mistakes we see owners make is waiting too long to start preparing for exit. If your desired exit is, for example, five years away, that means you have only 1,825 days, or 60 months, to get ready.

2. What Do I Need to Do Five Years Before Exiting?

Once you reach the point where your desired exit is five years (or less) from now, it is essential to begin defining your specific exit goals and laying the foundation of your exit plans. With that little time until you exit, five specific questions arise that owners must answer to define their exit plans.

The five critical questions are:

| 1 - What is My Likely Exit Strategy? |

| 2 - How Much Do I Need to Net From My Exit? |

| 3 - What Do I Want My Legacy to Be? |

| 4 - What Do I Want To Do in Life After Exit? |

| 5 - How Exitable is My Company? |

3. What is My Likely Exit Strategy?

The four potential exit strategies for a happy exit are:

- Pass to Family

- Sell to Outside Buyer

- Sell to Inside Buyer

- Planned Liquidation

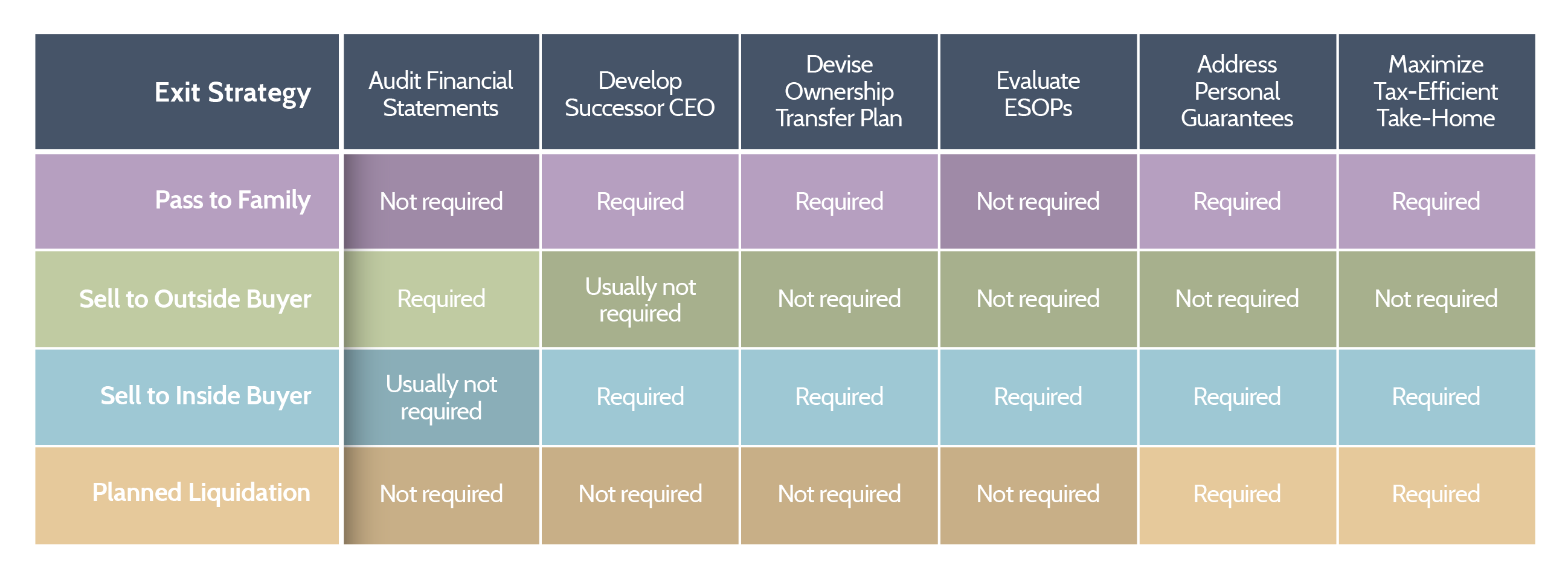

With five years or less before you desire to exit, you must identify which of the four is likely yours, because the issues and tactics used for each strategy are different. For example, if you want to pass your business down to your children, you face a different set of challenges and must pursue a different set of tactics than if you want to sell your business to an outside buyer. Likewise, selling your business to an outside buyer is a completely different process compared to selling to an inside buyer, commonly one or more key employees.

What is Your Most Likely Exit Strategy? (02:51)

Watch Video Now

To make this point clearly, the chart below lists at left the four different exit strategies. Then you will see six or seven common exit tactics, such as “Audit Financial Statements” and “Develop Successor CEO.” As you can see, which tactics are required differ among the four different exit strategies. As long as you don’t know which exit strategy is yours, you will not know which tactics must be pursued. With only fives years or less to prepare, determining your likely strategy is an imperative.

For further assistance in defining your exit strategy, we encourage you to download our NAVIX Exit Strategy Decision Tree™.

4. How Much Do I Need to Net From My Exit?

Time after time, client after client, research study after research study, the answer remains the same—business owners’ number one goal at exit is to achieve their financial win. In our experience, the most common financial goal at exit is to reach financial freedom, which means getting to the point where work is a personal choice, not a necessity. Money cannot buy happiness, but business owners who have reached financial freedom seem to smile on a regular basis.

How much do you need to achieve financial freedom?

Are you on track to reach financial freedom by your exit? How do you know? This may be one of the most important questions to accurately answer once you reach Your Last Five Years. If you are not on track to reach financial freedom but you still have five years before your exit, then you may have sufficient time to devise and implement a plan to meet your financial goals. However, if you only learn shortly before exiting that you will not reach financial freedom, there’s may not be enough time to do anything about it.

We use a proprietary model called the Exit Magic Number™ calculation to analyze for business owners how much you need to receive from the business achieve personal financial freedom at exit. Note that this calculation focuses on how much you need from the business at exit, not what your business is worth. This is different from the conventional wisdom, which focuses on making sure you get "making value" for your business. Of course there’s nothing wrong with selling your business for the highest possible price. But if you get maximum value for your business, and still fall short of your Exit Magic Number™, you might not be very happy at exit.

If reaching financial freedom is important to you, then your Exit Magic Number™ is the most important figure to know and track. To learn more, download our free ebook about Your Exit Magic Number™.

5. What Do I Want My Legacy to Be?

Several years ago, we were sitting in one of our conference rooms with a client. Laid out on the table in front of him were two written offers to buy his company. Both were all cash deals, but one offer was for several million dollars more than the other. The client sat there with his fingers kind of steepled under his chin, looking down at the two sets of documents, asking out loud, "Am I crazy? Am I crazy for even considering the lesser offer?"

Now, this client had not planned on selling his business. However, about six months earlier he had been diagnosed with a rare form of cancer. The survival rate was five percent after five years. Rather than spending his last few years working, he wanted to spend that time with his family. A thorough process marketing his company to several hundred potential buyers had produced these final two offers. Again, one was for several million dollars more than the other.

We sat there listening as the client kept saying, "Am I crazy? Am I crazy for even considering the lower offer, given the fact that my paycheck is going to be taken away from my family, with all of the medical costs that my family will face. Am I even crazy for even considering it?"

There is one word that summarizes why this client would even consider taking the lower offer: Legacy. This word causes more business owners emotion when they're standing on the one-yard line than any other one word. Few owners would define an exit as being “successful” if somehow their exit failed to uphold strongly-held values and beliefs. In this case, the client with cancer strongly suspected that the buyer offering more money was likely to run his company inconsistently with the values upon which he built his company. The client was worried about layoffs, and reduced service quality for customers. He felt conflicted—just how far did his responsibility to the business extend after he exited?

Of course, there is no right or wrong choice in a situation like this. And that’s part of the problem, isn’t it? Legacy is hard to define, but immensely powerful. Many owners surprise themselves by how important legacy motives become once they arrive at their exit.

Legacy is so powerful that it can veto price. For this client, he was willing to consider a lower purchase price for his company in order to achieve certain legacy outcomes. His illness may have been rare, but his dilemma was not. Many owners, whether they are sick or healthy, younger or older, consider taking a lower offer for their company if it means achieving their legacy aspirations.

If legacy is this powerful, how does one prepare for it, especially when most owners do not even share the same definition or application of the word? When we ask business owners legacy means to them, the answers will usually sound like this:

- "I want my company to survive”

- “I want my people to be treated fairly”

- “I want to protect our culture"

- "I want our customers to be well served”

- “I don’t want any surprises”

- “I want to feel like we did it the right way”

These answers seem to be all over the board. What does “protect our culture” mean? Culture is not static; it is ever-changing. How to know which changes would be welcome at exit, and which are not? How about “I want to feel like we did it the right way.” What is the “right way”? How will you know what is right for you, when you get to your exit? It’s probably not a good plan to just wait and see when you get there. Legacy needs to be better defined, and better planned for, well before you exit. Otherwise, you run the risk that when you do arrive at your exit, you will get caught unprepared, and unable to achieve whatever legacy goals and aspirations that you too will feel.

Thankfully, there may be a better way. After more than twenty-five years working with business owners, it’s my observation that to achieve whatever legacy aspirations they may have, owners must apply what I call The Three Laws of Legacy.

These Three Laws help owners identify what is important to them about legacy—well before the reach exit. Then, once you know that’s going to be important for you to accomplish—or avoid—at your exit, you can take steps now so that you are prepared when you do finally reach your one-yard-line.

The First Law of Legacy: Leave It In Good Hands

The First Law of Legacy is to Leave It In Good Hands. Whether you're planning on selling the company to an outside buyer, selling to your employees, or passing it to the kids, you likely will care about whether or not you leave the business in good hands once your exit.

So, what does “good hands” mean? There are two parts to it. The first part is leaders who will uphold the company’s essential values and culture elements. A key word here is “essential.” Not all values are equally important. And culture, as we have stated, changes with time. Therefore, it’s necessary to focus on the most important values and cultural elements that you wish to see upheld and continued. The challenge is that many companies do not define these top values and cultural elements, or define them in terms so vague as to not provide any real guidance.

The second piece of Leave It In Good Hands is the new leaders must be competent and committed. Competence and commitment are different, and both are needed. Competence means the new leaders have the skills and experience to run and grow the company after your exit. Commitment means they are professionally, and perhaps to some extent emotionally, vested in the company. You are. Ideally they will be too.

The Second Law of Legacy: Set It Up for Sustained Success

The Second Law of Legacy is to Set It Up for Sustained Success. When the subject of legacy comes up, some owners point out that once they’ve exited, the cannot control what happens to the company. As one client once said, “All I can do is make a hand-off, and then what happens after I’m gone is beyond my ability to control.” It’s true that you cannot guarantee the company will have a good future after your exit. This is not about controlling things after you are gone. It is about the state the company is in at the moment of your exit.

Years ago, a client contemplating his own exit said, "You know, my business feels like an unfinished painting. I can’t leave it yet. It feels incomplete." He really wasn't ready to leave yet because of the condition that the business was in at that point in time.

If the company is not set up for sustained success—meaning if there are visible reasons why the company likely will struggle in the foreseeable future, you won’t feel good about leaving your company in that condition. What happens in the future you cannot control. But you will care about how bright or dim that future looks at the moment of your exit.

There are three elements to Set It Up for Sustained Success:

- Does the organization have a credible and executable plan for growth after your exit?

- Are there adequate resources and capabilities to grow after your exit?

- Are there any known, insurmountable barriers to the company’s growth?

If you can answer these three questions favorably, then you may have done everything possible and reasonable to set the business up for sustained success. No business is without obstacles, competition, and external and internal threats. But to set your company up for sustained success means you have at least put the company in position where it could succeed.

The Third Law of Legacy: Go with Gratitude

The Third Law of Legacy is to Go with Gratitude. This third element of legacy has two elements to it. Before I address them, I realize this Third Law may sound somewhat preachy, right? After all, to say one is going to be gracious sounds self-congratulatory to some ears. But while others may benefit from any gratitude you demonstrate during your exit planning, this law is not really about them, just like the first two laws it’s about you. There's an increasing amount of science that shows more gracious people live longer, get sick less, make more money, and have better relationships. When you reach your exit, you will likely feel a need to thank some number of people for their contribution, typically starting with a handful of top employees. If, as part of your legacy plan, you anticipate this and prepare for it in advance, you will set yourself up for a more successful exit.

To apply this law, owners have to consider two questions:

- How do I determine who I need to thank?

- Then, how do I thank them?

Even when you figure out who to thank then you need to decide what you do for them? What does this thank you look like? Are these cash gifts? If so, how much is right? What are my other options besides money? And how much can you afford to spend, given that you have a finite amount of dollars and you still need to make sure that your personal financial goals are achieved at exit?

Thinking about, and preparing for these questions well before you exit saves time, reduces stress, and avoids making eleventh hour decisions at a very sensitive time. There’s another advantage to planning for how you will Go With Gratitude long before you actually exit. We advocate that you create incentive-compensation plans that provide exciting future compensation opportunities for your top employees. There are many different types of plans. The basic idea is to engage and incent your employees long before you intend to exit with potential future bonuses earned when the company and/or individual employee achieving certain growth goals and milestones. These future bonuses then serve double-duty—first they create an employee incentive and performance plan, and second at your exit they fund potentially exciting bonuses and payouts right at the time that you feel a need to say thank you.

Putting Golden Handcuffs on Key Employees

Where would your business be without your most valuable people? View On-Demand NAVIX Webinar

Do not feel however that cash is your only instrument – there are many ways to Go With Gratitude. Personalized gifts carefully tailored to an individual employee’s interests, hobbies, or bucket-list may be more appreciated than any amount of money. However, in my experience if you wait to figure this out until shortly before you exit, you probably will not time to give these questions the attention they deserve.

CONCLUSION

Applying the Three Laws of Legacy gives business owners a framework to approach an issue that is immensely important within the overall exit plan. As you get closer to your own exit, you likely will find that addressing legacy goals is very important, perhaps even to the point that whether or not you exit happily is determined by the legacy you leave behind. For most owners, a happy exit is not just about the money. Reaching personal financial freedom is a wonderful achievement, but it may feel less special if in the course of your exit, you had to sacrifice certain goals or values.

As for the client that I referenced at the beginning of this topic, the one with cancer? He took the lower offer. The lesser offer was still enough to provide for his family, which was his primary concern. He was not going to leave them financially insecure. But he did walk away from millions of dollars from the other buyer. The client died a few years later. He spent his final years entirely with this family. And at his funeral, practically every employee from his former company, and countless customers, were in attendance. He made the best legacy choice for himself.

6. What Do I Want to Do in Life After Exit?

Undoubtedly, you’ve noticed that in the U.S. we define ourselves strongly around our occupations. At social gatherings, when two people meet for the first time, usually the second question (the first being “What’s your name?”) is “What do you do for a living?”

For most of us, our occupations are a core element of our identity and sense of self-worth. For this reason, when faced with the question of what to do in life after the business exit, many owners understandably feel some level of anxiety and concern. That’s why figuring out your plans for life after exit is a critical issue.

Owners must address this question prior to their desired exit. You cannot assume that you will figure it out after you have exited. Figuring out your plans for life after exit often takes years. Waking up every day without something meaningful and interesting to do in life is not going to be a happy exit.

Five years before exit is when to begin exploring this issue, because answering the question takes time. If you have few to no ideas about what you might do in life after exit, you will need time to research and reflect. If you have ideas for life after exit, you will need time to test your plan. Perhaps the biggest mistake owners make with this question is that they never actually test their life after exit ideas. If you have some ideas about a new company, work on the business plan. If teaching sounds like fun, be a guest professor for a semester. If you want to open a winery, work harvest one fall. Whatever your ideas may be, test them. Nobody has a perfect track record of predicting their next calling or hobby. You must verify that your ideas will provide you with meaningful, engaging activities on a sustained basis.

To help you get started exploring your ideas for life after exit, review our list of 101 Questions to Help Business Owners Determine What to Do in Life After Exit.

7. How Exitable is My Company?

It’s not hard to know if a company is profitable—it’s right there, in black and white, in the financial statements. But what does it mean to say a company is exitable? And, just because a company is profitable, does that mean it is exitable?

Admittedly, we made up the word “exitable.” But if the word was real, what would it mean? Well, an exitable company would be one from which the business owner or owners can actually exit. That would mean the company has value—value that is convertible into personal wealth and financial independence for the owner. Exitable would also mean that the company can survive the exit process, without disrupting operations and critical relationships. The bottom line is an exitable company is one that can fulfill the owner’s business and personal goals at exit.

With that definition in hand, let’s now ask—if a company is profitable, does that mean it is exitable? This question is important because most owners go to work every day challenging themselves and their teams to “grow” the business. “Growth” is primarily measured by revenue and profits. If growing profits does not necessarily make a company more exitable, that would be very important to know.

Unfortunately, it turns out profitability and exitability are not the same. And sometimes owners only learn very late—meaning shortly before they wish to exit, at which point their exit success is undermined, or perhaps even blocked outright.

There are a surprising number of ways that businesses can grow and operate profitably, without necessarily being exitable.

Here are four common situations where this can occur.

1. Owner Dependency

The first common limitation on exitability is owner dependency. If your business is dependent on you, or any other owners, to operate and grow profitably, this typically limits exitability. The company’s value cannot walk out the door when you do. It’s ironic too because your company probably would not be what it is today if you had not worked as hard as you have up to now, perhaps over many years. It’s great to be good at what you do, but if your company is losing an essential employee when you exit, that undermines exitability. It’s not enough either just to say that the company could manage to survive without you. It has to be able to thrive without you. Buyers want to know that the business’ profits will not slow down nor go away when you do.

2. Customer Concentration

The second common limitation on exitability is customer concentration. This matter may surprise you because customer concentration is usually a byproduct of a job well done. Your company may have one or a few customers that are served well, and they've responded by sending more and more business your way. But then, one day, you look around, and 20%, 30%, 50%, or more of your revenue and profits comes from these few customers. These customers might be generating a lot of profits, but customer concentration usually limits exitability. If you intend to sell your company one day, your future buyers likely won’t have longstanding relationships with these customers, creating risk for them. Buyers often pay less for companies with customer concentration or pass on purchasing that company altogether. Customer concentration thus becomes a serious limitation on exitability, no matter how profitable those customers may be.

3. Co-Owner Goal Misalignment

The third way many companies experience limited exitability is if they have co-owners who are not in alignment with one another. We did a research study some years ago, and it revealed that 7 out of 10 small to medium sized privately-owned companies have ownership shared among two or more co-owners. We often see co-owners who are in strong alignment with one another for years and sometimes even decades while they are working together to grow the business because they share one clear priority, which is to increase revenues and profits. The problem arises when one or more of those co-owners get closer to exit because then the goals often change, and the co-owners find themselves no longer in alignment. For example, one co-owner may want to sell now, while another wants to wait. Or, one co-owner may decide to sell for lower price, while another wants to keep growing the company and hold out for a higher price. Whatever the situation, when the goals change, the co-owner alignment changes, and often the co-owners don't even realize it's happening until close to exit, at which point it can ultimately undermine a company’s exitability. No matter how profitable your company may be, if the co-owners are not in alignment, exitability will suffer.

4. Unclear Plan for the Future

The fourth way companies experience reduced exitability, regardless of profitability, occurs if the company lacks a clear, compelling plan for future growth. For a company to be highly exitable, it must offer a buyer or successor a credible and compelling vision for how that company will grow going forward, after your exit. How profitable the company has been up to this point is nice, but what the company is expected to do in the future drives value and exitability.

Many profitable companies don’t have the systems and habits that help create this compelling plan for future growth. For example, the company leadership team might not do sound strategic planning, or perhaps they do not diligently measure monthly or quarterly performance against financial budgets and operational benchmarks. Without experience doing effective strategic planning, and without a clear track record of being accountable for achieving business goals, it may be unclear to the future buyer or successor whether this company can sustain its future growth after your exit. This shortage undermines exitability, even if the profitability has historically been good.

To learn more about the factors and conditions within practically any business that will increase (or decrease) its value at sale, we invite you to view our complimentary webinar: How Do I Maximize the Value of My Company?

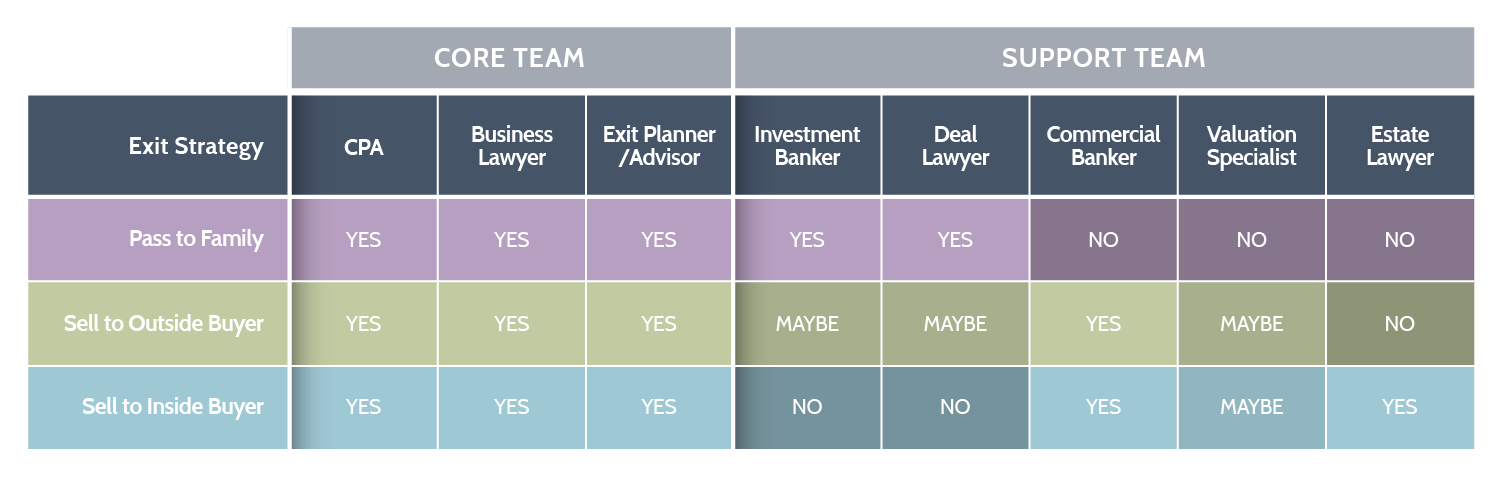

8. Once I Reach Five Years, Who Should I Turn to for Help?

Once you arrive at Your Last Five years, it is time to assemble your exit advisory team. Trying to exit without professional help is a recipe for frustration and possible failure. First, there will be highly technical legally, tax, accounting, and financial issues to address. Second, preparing for exit can take hundreds and sometimes thousands of hours of work. This work must be done, but you and your management team cannot afford to take your eyes off the company during Your Last Five Years. Bringing in outside help during these last five years adds much needed bandwidth. Last, if you are selling your company then your buyer likely will have more experience doing deals than you do, and will deploy a team of expert accountants, attorneys, and bankers against you. (You would too if in their shoes.) You will need your own team of experts working to achieve your goals and protect your interests.

For these reasons, you need a competent advisory team. The team can be broken down into two components: a Core Team that every business owner needs, and a Support Team which varies by your likely exit strategy, as indicated in the chart below.

Once you have your Core Team identified, the next step is to meet with them as a group. Share with them your answers to the five questions presented above. Your answers to the five questions will help the team understand your goals, so they can begin the process of designing your specific exit plan.

Remember—you have only one shot at exit success.

9. Is There a Cost of Waiting to Get Started?

Many business owners put off starting their exit planning—for understandable reasons. You are busy. Your business needs constant attention. Planning for exit takes time and hard work. As long as the business is profitable and fun, why rush to work on a future exit?

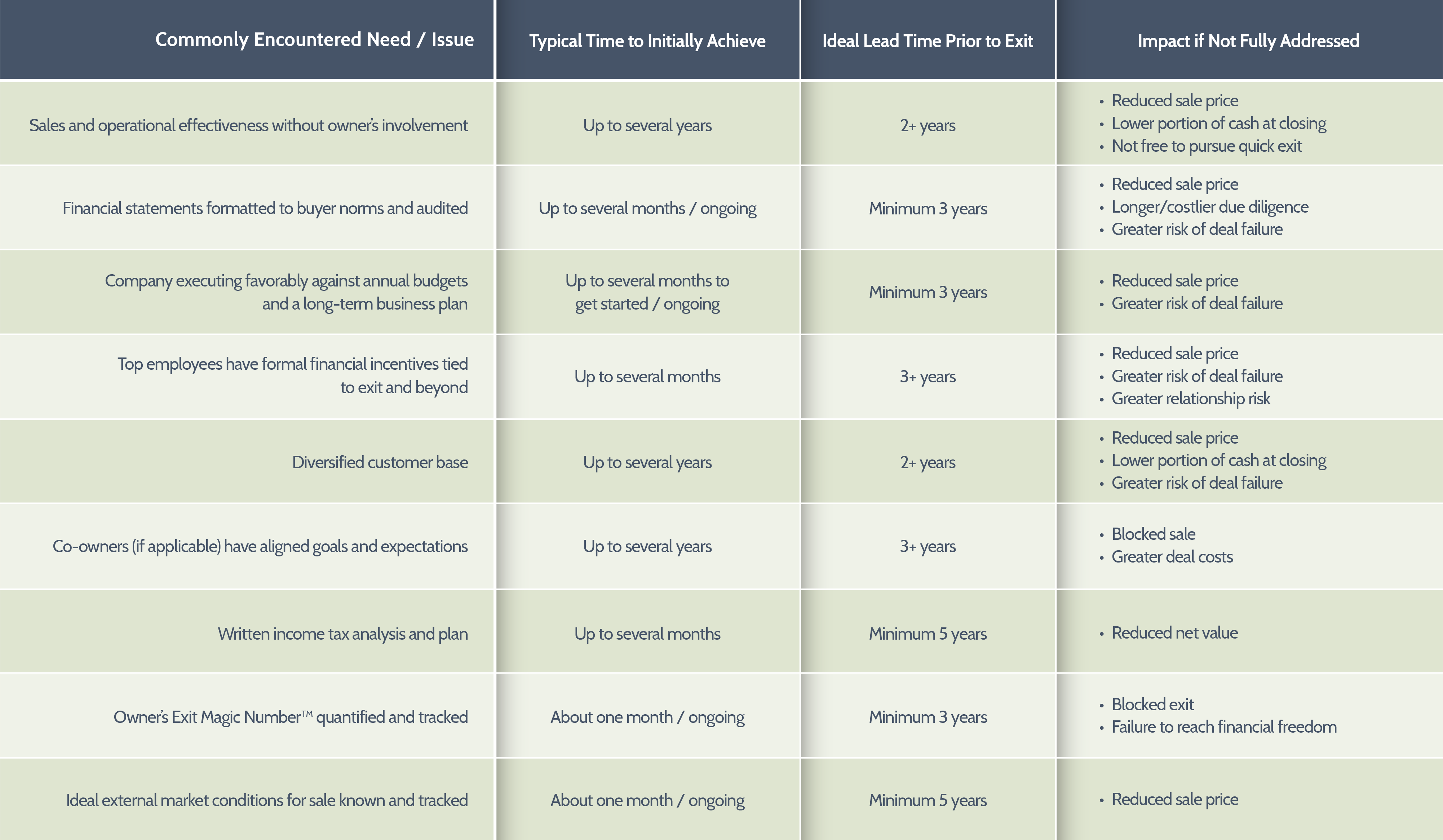

However, there is a significant cost of waiting. The longer owners wait to prepare for exit, the higher the cost to exit likely becomes. Here’s why. Preparing for exit takes time—time that many owners do not have in abundant supply. If time is limited, then the things you can do to prepare yourself and your company for exit are limited too. Once you reach the point where your desired exit is within the next five years, you may start to encounter issues that there will not be enough time to address.

Here are some specific examples. Of the four possible exit strategies (See Chapter 3), the most common three are: Sell to an Outside Buyer, Sell to an Inside Buyer, and Pass to Family. For each of these exit strategies, the charts below list just some of the specific issues commonly encountered by owners seeking to exit using that strategy. Failing to fully address any one of these issues can undermine or even block your exit success. As you can see, getting everything done keeps you busy during your final five years.

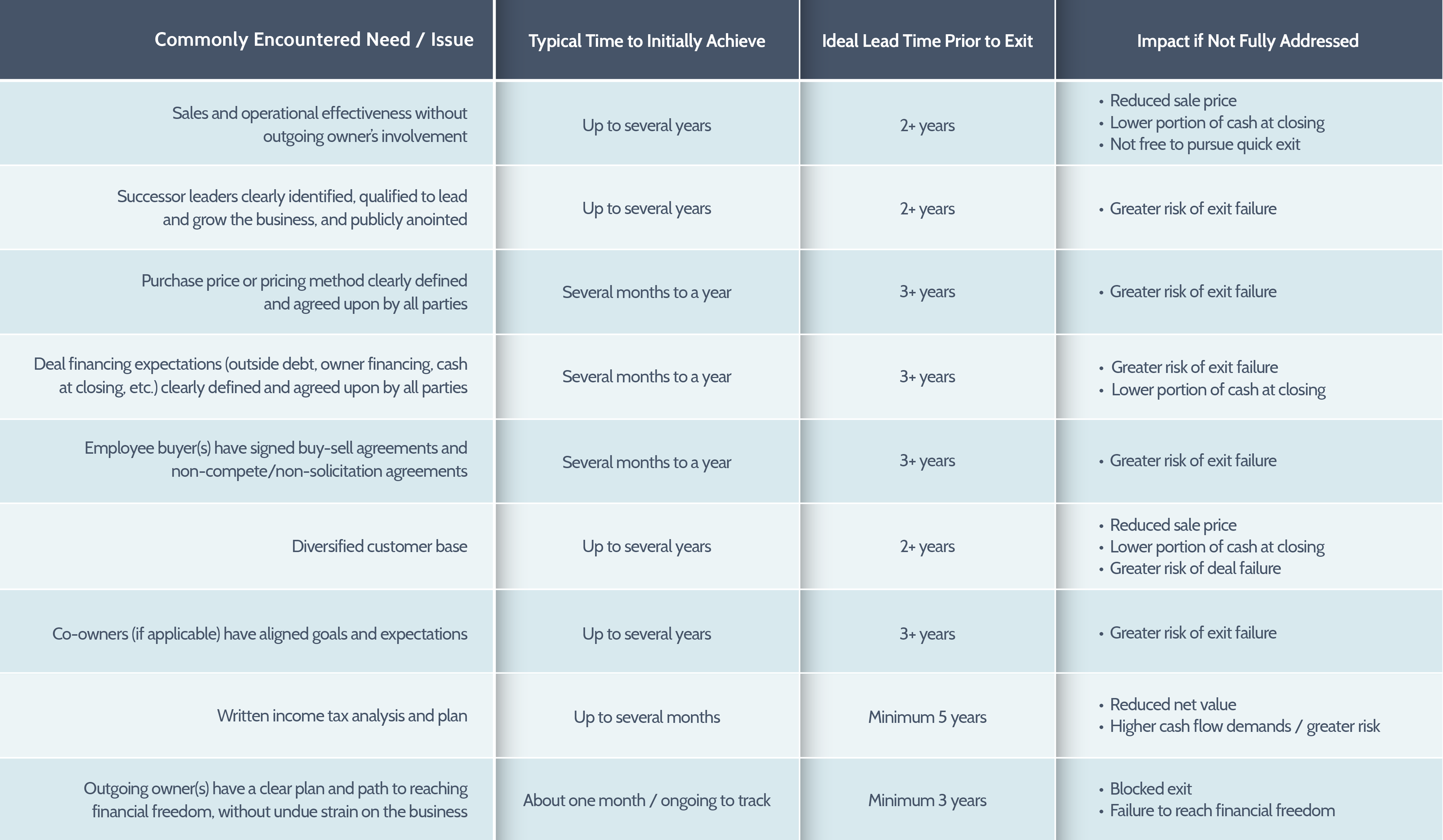

Below are just some of the needs or issues commonly encountered by owners seeking to exit by selling the business to an outside buyer. Failing to fully address any one of these issues can reduce the sale price and undermine exit success. Getting everything done can easily consume an entire five years.

The Cost of Waiting

“Sale to Outside Buyer” Exit Strategy

Below are just some of the needs or issues commonly encountered by owners seeking to exit by selling the business to an inside buyer. Failing to fully address any one of these issues can undermine or deny exit success. Getting everything done can easily consume an entire five years.

The Cost of Waiting

“Sale to Inside Buyer” Exit Strategy

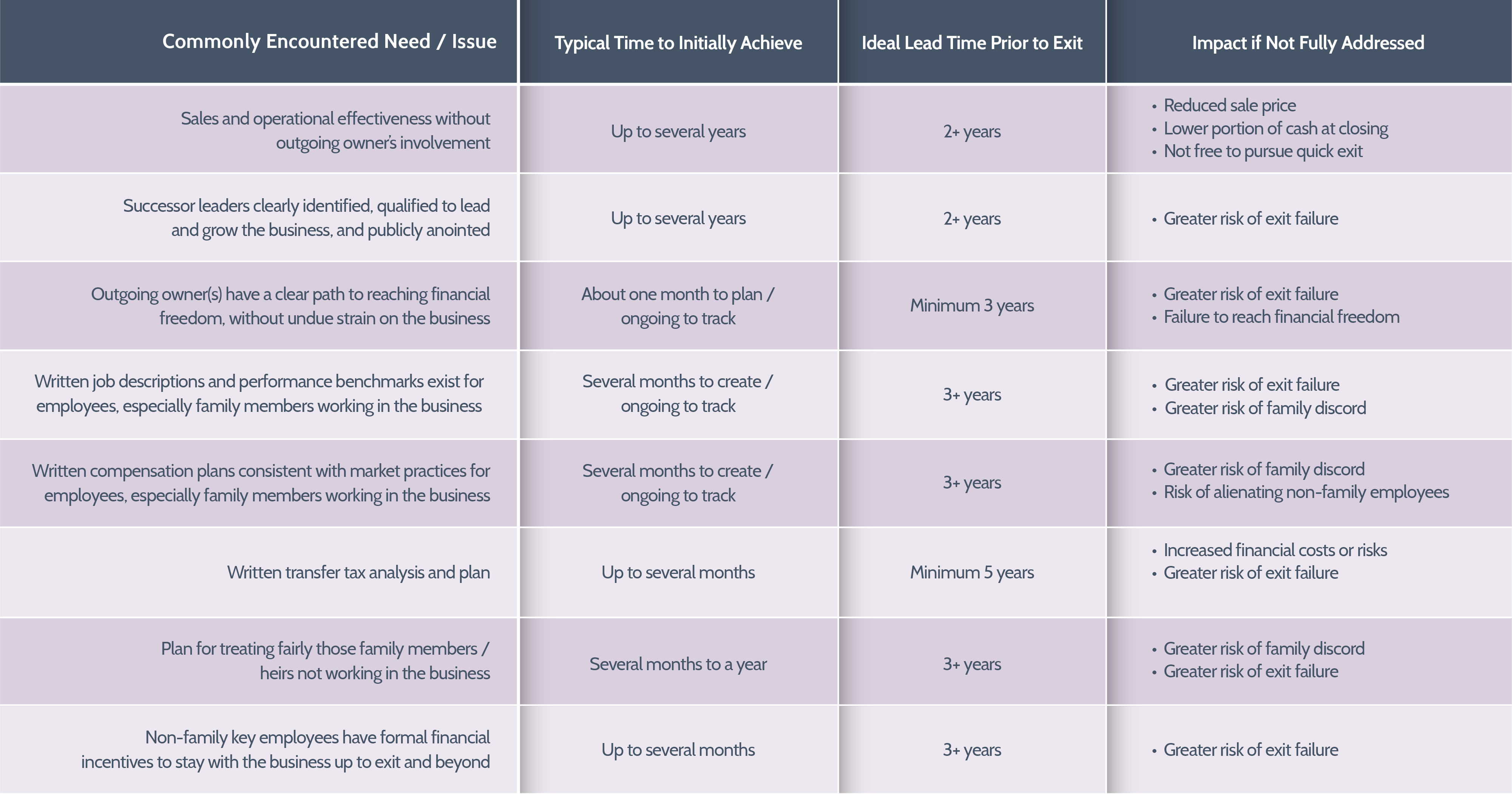

Below are just some of the needs or issues commonly encountered by owners seeking to exit by passing the business to family members. Failing to fully address any one of these issues can undermine or deny exit success. Getting everything done can easily consume an entire five years.

The Cost of Waiting

“Pass to Family” Exit Strategy

How can you combat the cost of waiting? Benjamin Franklin provided the answer: "An ounce of prevention is worth a pound of cure." Getting started working on your exit as early as possible—ideally not later than five years before your desired date — fulfills Mr. Franklin’s wise insight. At NAVIX, we help business owners achieve exit success one ounce at a time:

- Engaging a NAVIX Consultant up to five years prior to exit gives owners the expertise and assistance to design your exit plan.

- Our flat monthly fee structure offers predictability, objectivity, and transparency.

- Working with NAVIX several years before exit helps reduce total exit cost and/or increase net value by: implementing tactics to overcome factors likely to reduce value at sale, minimizing surprises, avoiding mistakes, and (working with your tax advisors) potentially reducing taxes.

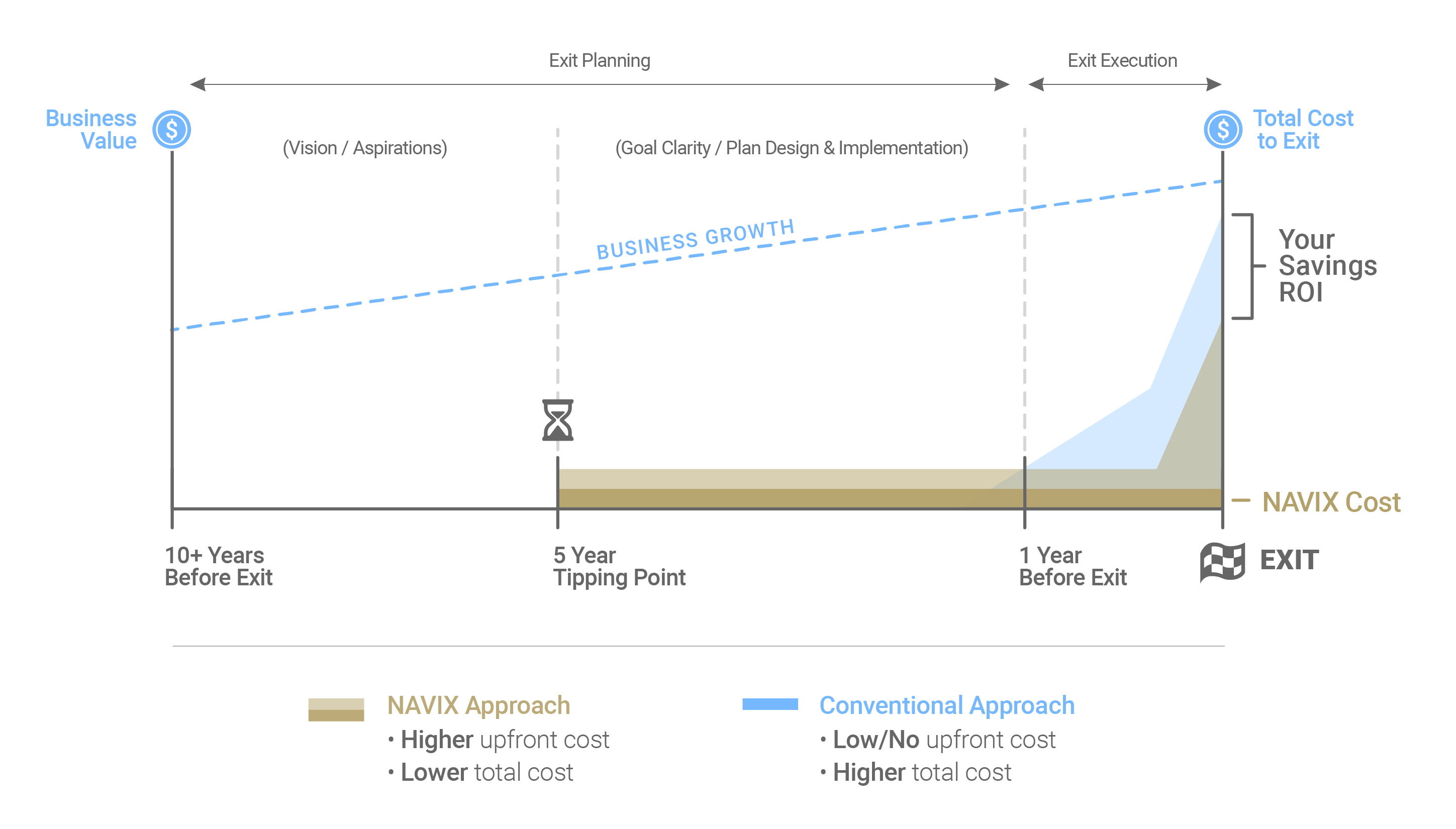

The chart below illustrates the potential results from the NAVIX Approach. As shown, the NAVIX Approach features a low flat cost to start one’s exit planning much earlier—ideally five years before exit. In contrast, the “Conventional Approach” to exit planning typically sees owners waiting until about a year or so before exit to commence serious preparations. As a result, NAVIX client may potentially achieve greater exit success at a lower total cost.

The Cost of Waiting

Conventional Method vs. NAVIX Approach<

10. What Are My Next Steps?

Once you arrive at Your Last Five years, it is time to assemble your exit advisory team. Trying to exit without professional assistance is a recipe for failure, and you have only one shot at exit success. First, there will be many highly technical issues to address during exit dealing with legal, tax, accounting, and financial issues. Second, preparing for exit takes hundreds and sometimes thousands of hours of work.

You and your management team likely cannot afford to take your eyes off the company ball during the Last Five Years, so outside expert help brings needed bandwidth. Last, if you are selling your company then your buyer likely will have more experience doing deals than you, and will use this experience against you if you don’t have your own team of experts.

Your advisory team can be broken down into two components, a Core Team that every business owner needs, and then a Support Team which varies by your likely exit strategy, as indicated in the chart below. (Remember, selecting your likely exit strategy is one of the questions that must be addressed when you reach Your Last Five Years.)

Once you have your Core Team identified, the next step is to meet with them as a group and share with them your answers to the five questions reviewed on this page.

And remember...

We hope you found what you were looking for.

However, if you still have questions that were not covered here – we invite you to search our site for more answers to your important exit planning questions.